Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to. Five days of FREE Family Fun.

Return economy airfare for East Malaysians or return transport allowance for West Malaysians.

. Company Annual Return In Malaysia. Capital Adequacy Asset Classification Provisioning NOF etc. Revision and expansion of the loansfinancing data in the Monthly Highlights and Statistics and Financial Inclusion Data for Malaysia microsite from August 2022 publication onward.

In case of Nil GST Return filing the maximum penalty on late filing will be INR 500 250 CGST 250 SGST. Annual Multi Trip Travel Insurance. I am honored to release the 45th annual Country Reports on Human Rights Practices and to reaffirm the United States commitment to placing human rights at the center of our foreign policy.

The cause of human rights freedom and dignity is close to the American heart. Bank Negara Malaysia BNM is pleased to inform that from August 2022 onwards the publication of statistical tables related to loansfinancing will be. Incentive An incentive on income tax is given for 5 years which is calculated based on a formula.

In Malaysia corporations are subject to corporate income tax real property gains tax goods and services tax GST and etc taxes. The form and instructions are available on IRSgov. A 5000 fee per tax return applies.

DNBS-04A Return Short Term Dynamic. Complete the form. Aug 06 2022 10-1130am Okanagan Lake Park Penticton Peach Festival is an annual South Okanagan Valley tradition which began in 1947 to celebrate the peach harvest in Penticton British Columbia Canada.

Form 4506 Request for Copy of Tax Return PDF is used to request a copy of previously filed tax returns with all attachments. Get the most out of Malaysias banks and finance companies when you save invest insure buy and borrow. KEY DATES Tue 15 Mar to Fri 10 Jun.

Credit Card Reviews Reviews for the top credit cards in Malaysia. Find the answers to these questions and more in the 2022 Hays Asia Salary GuideThe salary and sector overviews plus insights from a survey of over 9000 employers and professionals across China Hong Kong SAR Japan Malaysia and Singapore will enable you to navigate the new world of work more effectively in the year ahead. Examination fees for GCE O-Level and A-Level once only as applicable.

File yours on EbizfilingCall on 91 9643203209. GST Return Late Payment Fees GSTR 1 and GSTR 3b. NBFCs-D and NBFCs-NDSI and Non-NDSI NBFCs having asset size more than 100 cr.

Understand if you are liable to file the return. Form ITR 1 to ITR 7 for filing. Malaysia Companies Act 2106 Company Accounting Clauses.

Understand the pros and cons for each card and discover the features and benefits that could save you thousands of ringgit every year. The return captures compliance with prudential norms eg. When you get a quote for your trip you will also have the opportunity to get an Annual Multi trip quote.

Malaysia Companies Act 2106 Company Auditor Clauses. Annual allowance with hostel accommodation. While annual allowance is a flat rate given every year based on the original cost of the asset.

Income Tax Department has notified 7 various forms up till now ie. Subsidised medical benefits and insurance cover for accidents. If you are not sure what your best option is please give us a call so that we can guide you in the right direction for.

For NBFC-Deposit taking NBFC-NDSI. MGT-7 Pursuant to sub-Section1 of section 92 of the Companies Act 2013 and sub-rule 1 of rule 11of the Companies Management and Administration Rules 2014 Annual Return other than OPCs and Small Companies I. Know who needs to file Form 3CEB preconditions Procedure etc.

Private Limited Company Annual Filing. As President Biden emphasized We must start with diplomacy rooted in Americas most. In other words resident and non-resident organisations doing business and generating taxable income in Malaysia will be taxed on income accrued in or derived from Malaysia.

REGISTRATION AND OTHER DETAILS i Corporate Identification Number CIN of the company L85110KA1981PLC013115. Form 4506 has multiple uses and special attention must be taken when completing the form for a gift tax inquiry. A notice of meeting the Board shall be sent to every director who is in Malaysia and the.

In similar form and each document shall be signed or assented to by one or more directors. CYCLE CARRIAGE BINTANG MALAYSIA. Banking Terms Definitions.

We retail and provide After-Sales Services for Mercedes-Benz vehicles in Malaysia. For offshore trading companies that are approved and are operated by non-residents of Malaysia by using a website in Malaysia for sale of foreign goods outside Malaysia an exemption is provided. The annual allowance is given for each year until the capital expenditure has been fully written off unless the fixed asset is sold scrapped or disposed in which case a balancing allowance or balancing charge will be calculated.

If the preceding financial years annual turnover was less than INR15 crore a late fee of up to INR 2000 per report can be levied INR 1000 each for CGST and SGST.

Malaysia Tax Guide What Is And How To Submit Borang E Form E

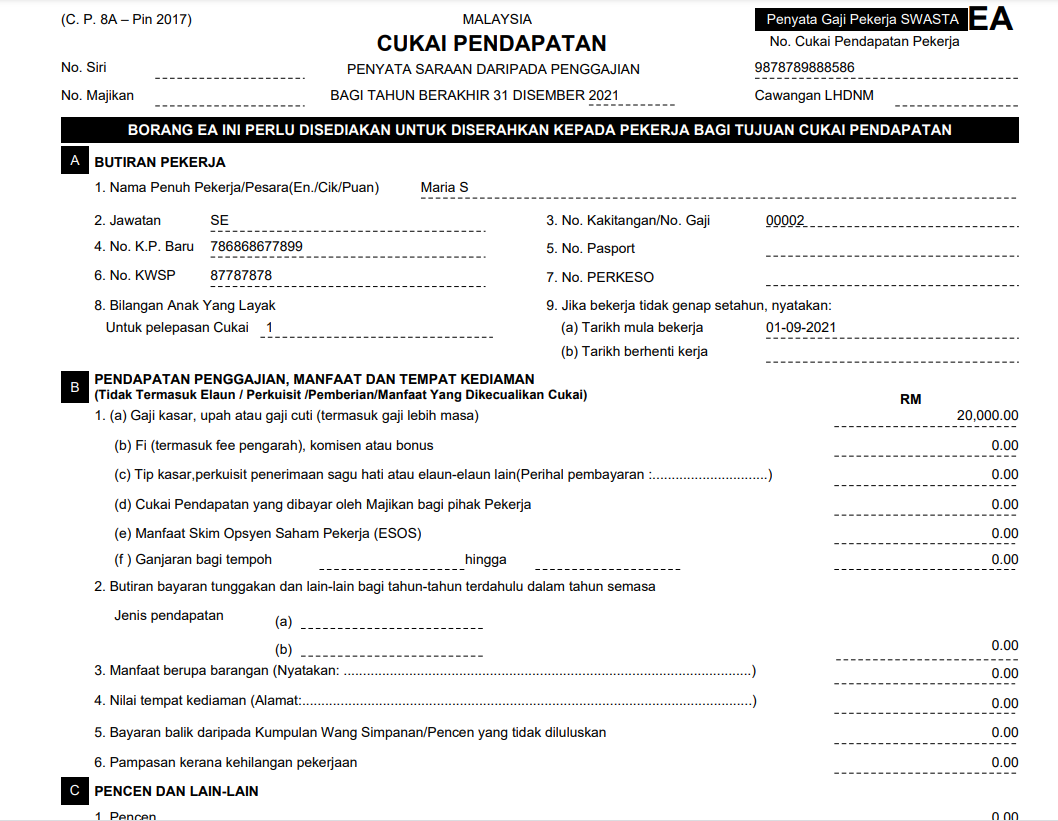

Malaysia Payroll Compliance How To Generate Ea Form In Deskera People

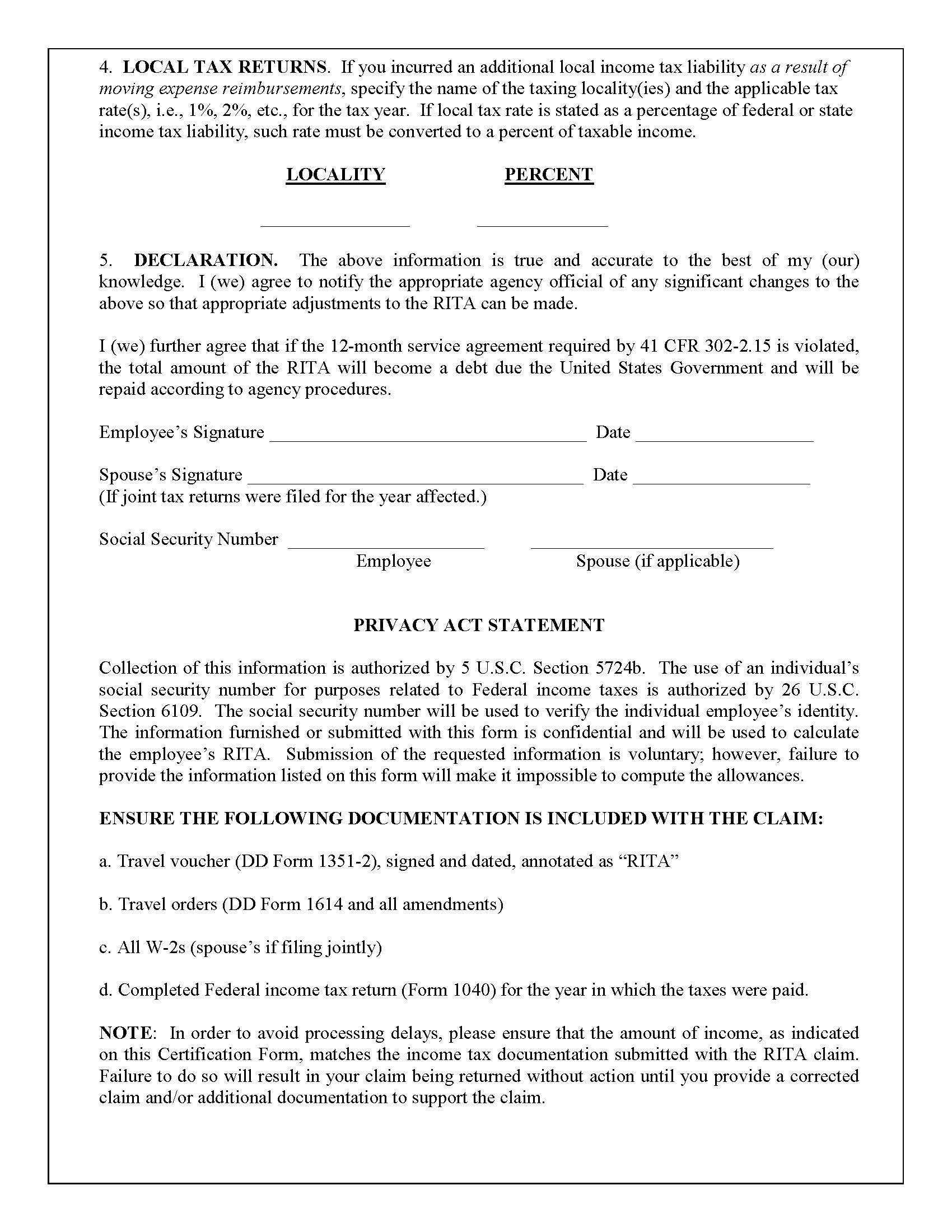

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

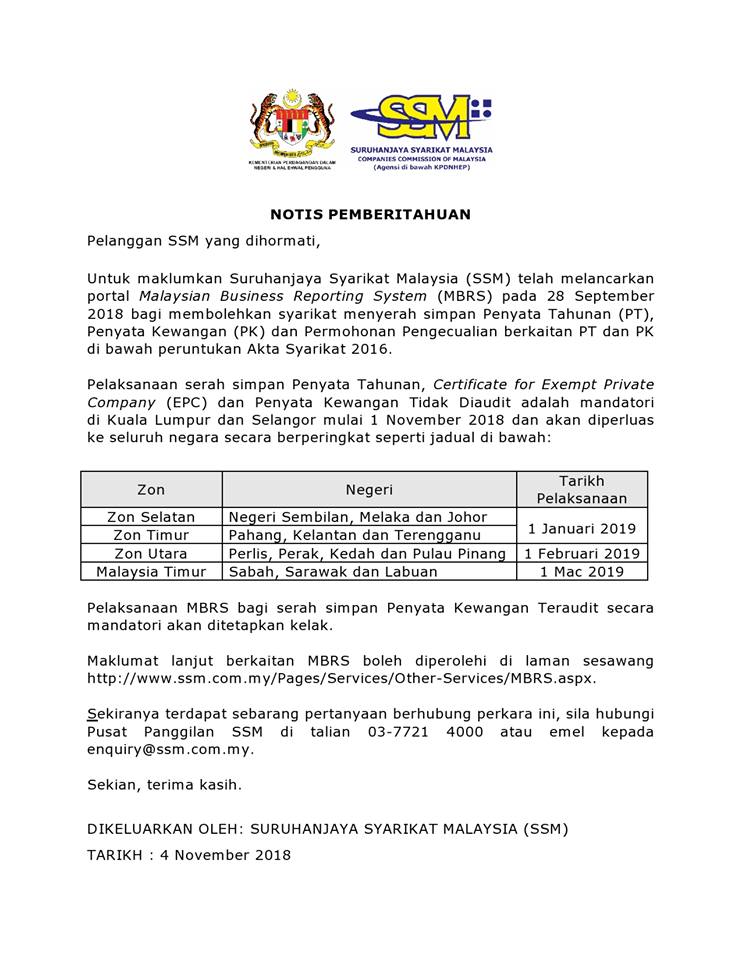

St Partners Plt Chartered Accountants Malaysia Ssm Duty To Lodge Annual Return Dated 31st December 2018 And Financial Statements For The Financial Year Ended 30th June 2018 Facebook

Tp1 Form Tp2 Form Tp3 Form Malaysia Free Download Sql Payroll Hq

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Sample Letter Of Intent Letter Of Intent Letter Sample Letter Example

Mco News Updates Suruhanjaya Syarikat Malaysia

Form 24 Return Of Allotment Of Shares Company Registration In Malaysia

Understanding Lhdn Form Ea Form E And Form Cp8d

Https Bohoot Blogspot Com 2021 02 Car Rental Agreement Template Australia Html Rental Agreement Templates Agreement Car Rental

Form 9 S17 Know The Statutory Forms Of Your Sdn Bhd Foundingbird

Business Income Tax Malaysia Deadlines For 2021

Preferential Certificate Of Origin